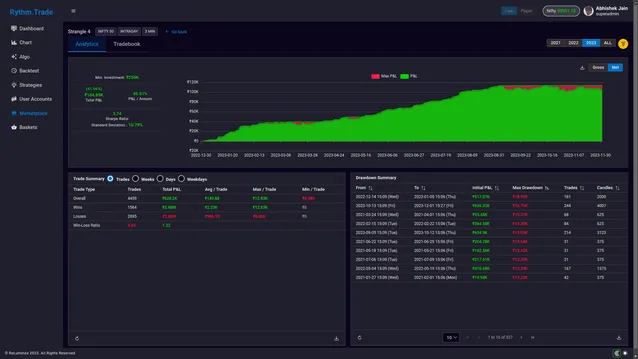

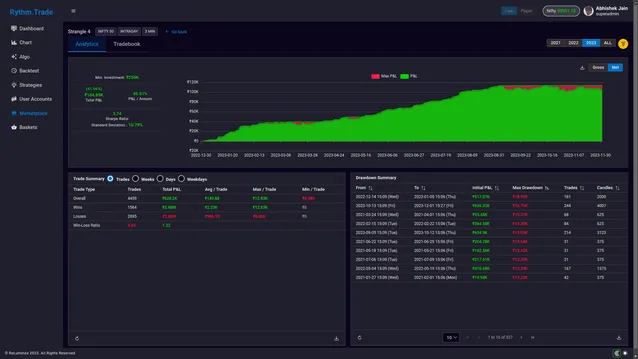

A thought to action platform.

Rythm provides standardized data for traders, tools to test market hypothesis, and access to robust order & execution framework custom to the idea that is intended to be traded.

Rythm provides standardized data for traders, tools to test market hypothesis, and access to robust order & execution framework custom to the idea that is intended to be traded.